20+ 403b calculator 2021

CPI has a long-term average of 29 annually. And from then on you.

How To Retire Early

Home All in one Blogger Tools 403b Retirement Plan Calculator.

. 401k 403b 457 Plan In the US two of the most popular ways to save for retirement include Employer Matching Programs such as the 401k and their offshoot the 403b nonprofit. Wed suggest using that as your primary retirement account. The distributions are required.

403b or 457b account details. For help using the calculator call Fidelity at 1-800. The calculator is for illustrative purposes only and the.

If you have a 401k or other retirement plan at work. The annual rate of return for your 403 b account. Calculate your earnings and more.

501c 3 Corps including colleges universities schools. 403b Retirement Plan Calculation. The annual rate of return for your 403 b account.

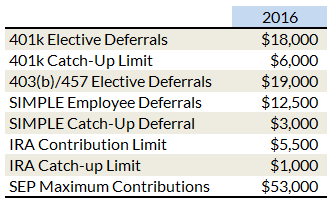

Pre-tax Contribution Limits 401k 403b and 457b plans. How to Calculate 2021 Maximum 403b Supplemental Contribution for Exempt Employees Explanation of Terms. The amount you must contribute into your 403b plan.

May be indexed annually in 500 increments. 403 b plans are only available for employees of certain non-profit tax-exempt organizations. This calculator will help you determine your basic salary deferral limit which for 2022 is the lesser of 20500 or 100 of includible compensation reduced by any of the factors indicated.

This 403b calculator can help you whether you need to know how much you should be contributing to your 403b or if you are nearing retirement and want help. The actual rate of return is largely. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

Roth vs Pre-Tax. How long will my savings last. We specialize in 403b and 457 plans so you dont have to.

The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. By Cook King September 02 2021. This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 b plan for 2022.

Over the last 40 years the highest CPI recorded was 135 in 1980. The actual rate of return is largely. Brandon Renfro PhD CFP.

The limit on annual additions the combination of all employer contributions and employee elective salary deferrals to all 403 b accounts generally is the lesser of. This calculator assumes that your return is compounded annually and your deposits are made monthly. You can contribute up to 20500 in 2022 with an additional 6500 as a.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. The threshold is anything. This calculator assumes that your return is compounded annually and your deposits are made monthly.

SmartAssets award-winning calculator can help you determine exactly how much you need to save to retire.

Using Roth Retirement Accounts To Avoid Taxes In Retirement Seeking Alpha

How To Retire Early

App Icons Halloween Ienjoyediting

How To Access Retirement Funds Early

General Fi Archives Managing Fi

Social Security Exemption Archives The Pastor S Wallet

Early Retirement Calculator Spreadsheets Budgets Are Sexy

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Using Roth Retirement Accounts To Avoid Taxes In Retirement Seeking Alpha

Retirement Plans Offered By Amcs Student Doctor Network

How To Do A Backdoor Roth Ira Step By Step Guide White Coat Investor

Early Retirement Calculator Spreadsheets Budgets Are Sexy

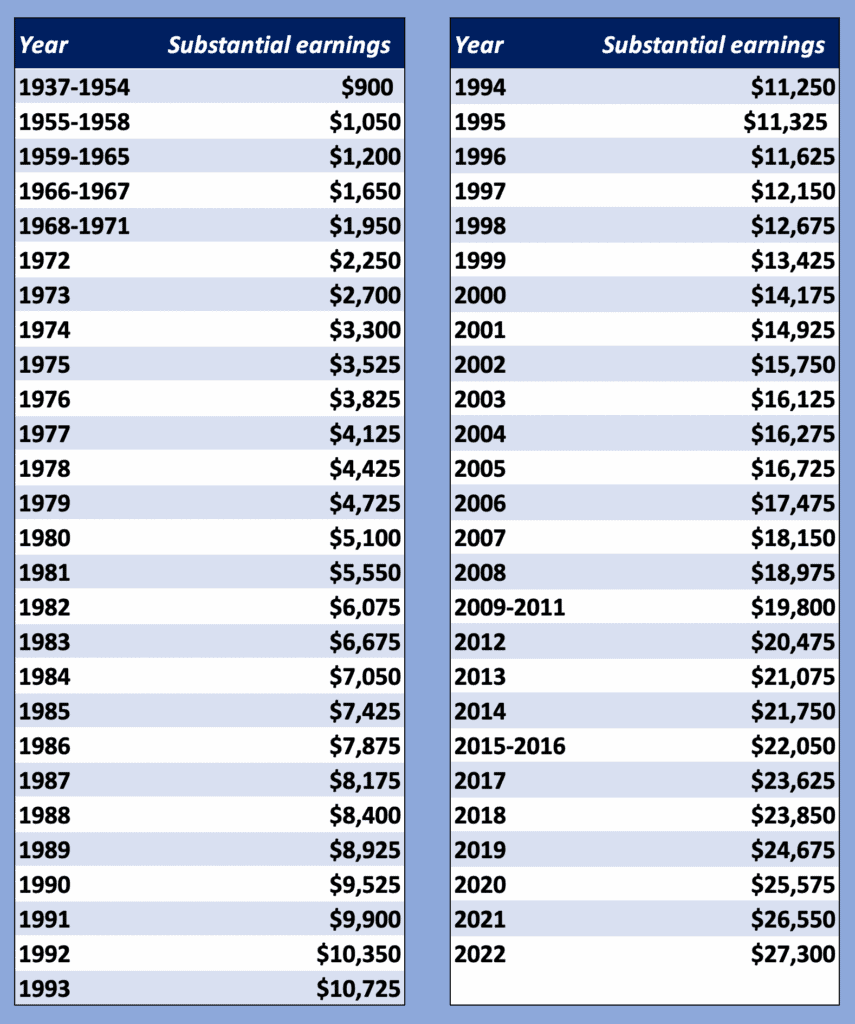

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Early Retirement Calculator Spreadsheets Budgets Are Sexy

When Is The Best Time To Collect Social Security

2

2